-

What Is Invoice Factoring?

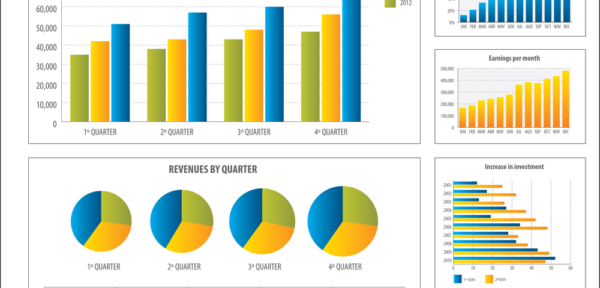

When a business needs cash but doesn’t want to borrow money they can turn to Invoice Factoring. Rather than a bank loan, outstanding invoices are sold to a factoring company. Learn more

-

Benefits of Factoring Invoices

If your business wants working capital to pay bills, fund growth, or negotiate discounts then it’s time to consider factoring invoices.

-

Factoring Application

Why wait 30, 60, or even 90 days for your customers to pay you? We can help turn invoices into cash with accounts receivable factoring!

FACTORING SOLUTIONS

Why wait 30 to 60 days for your customers to pay you? Selling business invoices can provide the cash flow relief to pay bills, fund growth, earn discounts, and increase profits! Learn More About How Factoring Works!

You might be wondering...Why Would I Sell Invoices? How Much Does Factoring Cost? Does My Company Qualify for Accounts Receivable Funding?

Get Answers to Frequently Asked Questions!

Tips For A Smooth Factoring Application

Every day business owners juggle the cash flow demands of their companies. More than ever, they are turning to invoice factoring as a trusted solution, because of its fast turnaround and flexible terms. If you are considering accounts receivable funding it pays to be prepared. Save time and money by understanding these five tips: … [Read More...]

How to Reduce the Costs of Factoring Invoices

When a business needs cash they often turn to factoring accounts receivable as a financing solution. Of course a factoring company expects to earn a profit on the cash advance and charges a fee for their service. Since the overall goal is improved cash flow, a company considering accounts receivable financing will carefully weigh the benefits … [Read More...]